The horrific death of George Floyd in May 2020 and the subsequent Black Lives Matter movement shone a spotlight on systemic discrimination within organisations. Since then many have been examining their roots to identify whether they are founded on racism. Social housing has that same responsibility, and it may help us understand why racial discrimination persists in current activities and practices.

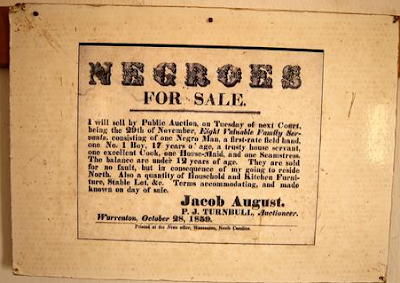

The Transtlantic Slave Trade saw 12 - 12.5 million people transported from central and west Africa to the Americas where they were put to work growing crops such as sugar, cocoa, coffee, cotton and tobacco. As property, the people were considered merchandise or units of labour, and were sold at markets with other goods and services.

These crops generated vast wealth for many traders in Europe, and from 1769 to 1853 Britain dominated. After the Slavery Abolition Act of 1833 the following decades saw slave trading gradually reduce. How could this atrocious period in our history be connected to the original social housing tenants? What is the connection between the Transatlantic Slave Trade and those early pioneers, Joseph Rowntree, William Sutton, George Peabody, Lord Shaftesbury and John Cadbury?

The Joseph Rowntree Housing Trust has its origins in a grocery business established in York by Joseph Rowntree Senior in 1822. Among other things, the businesses sold commodities of empire which are likely to have been produced by enslaved or unfree workers. The Rowntree Company benefited from colonial indenture, a system of bonded labour in which European imperial powers recruited people from India and Southeast Asia to work on plantations in the Caribbean and West Africa and in the 1890s. Rowntree & Co. purchased several plantations in the British West Indies on the islands of Dominica, Jamaica, and Trinidad. In April 2021, the Rowntree Society issued a statement exploring their links with the Transatlantic Slave Trade.

William Sutton, born in 1833, left a £1.5m fortune in his will (which would be worth £197m today) to provide much needed housing for those who couldn’t afford it. His wealth grew from the UKs first parcel delivery service but in the 1880s he also created two companies that traded in tea, coffee and tobacco from the Americas. The William Sutton Housing Trust built some of the country’s first housing estates, such as the Sutton Estate in Chelsea, London. By 1939 the Trust was providing homes for 32,000 people. The William Sutton Housing Trust is now part of the Clarion Group.

George Peabody was a wealthy American financier and philanthropist who was born in Massachusetts in 1795. His early career was in the shipping and banking industries and he established a successful business in Baltimore, Maryland, which was then a slave state. Peabody's business dealings with slave owners and slave traders have led many historians to conclude that he was directly involved in the slave trade.

In 1837, Peabody moved to London. He continued to be involved in banking and finance and became one of the wealthiest men in Britain. Peabody also became a major philanthropist, donating large sums of money to educational and charitable institutions. In March 1862 the Peabody Trust was set up with £150,000. He increased this to £350,000, before his death in 1869, with a further £150,000 in his will. By 1914 it had built 6,400 homes.

The 7th Earl of Shaftesbury’s family had a history of involvement in the slave trade. His grandfather, the 5th Earl of Shaftesbury, was a slave owner, and his father, the 4th Earl of Shaftesbury, inherited a number of plantations in the West Indies that were worked by slaves. The 7th Earl, Lord Shaftesbury, was a hugely successful social reformer of nineteenth century England. His deep compassion for the poor was legendary, as were his tireless campaigns to limit factory hours, stop the use of boys as chimney sweeps and children in coal mines, and to develop universal education. In 2007, Shaftesbury Housing Society became part of Sanctuary Housing.

The Cadbury family was a wealthy Quaker family from Birmingham, England. They made their fortune in the chocolate industry. The chocolate they produced was made with sugar and cocoa produced on plantations in the Caribbean, where slaves were forced to work. In 1900, they created Bournville Village Trust that went on to build 400 homes.

The Cadbury family was aware of the cruelty of slavery, and they spoke out against it. In 1824, the family's patriarch, John Cadbury, joined the Society for the Abolition of the Slave Trade. The family also donated money to organisations that were working to abolish slavery. Slave labour was being used on plantations in the Gulf of Guinea, off West Africa. Yet it wasn’t until 1908 that William Cadbury had located an alternative source for cocoa supplies and announced a boycott on slave-grown cocoa from São Tomé and Príncipe, allowing them to maintain their chocolate production.

In recent years, the Cadbury family has acknowledged its involvement in the slave trade. In 2015, the family issued a statement apologising for its role in the trade.

These originators of social housing transferred the wealth generated from their business activities to their home country where some was used to benefit the poor. Today, where those assets are still held by the landlord, they remain as security for present day loans. Whether involvement in the Transatlantic Slave Trade reflect in todays attitudes and practices is debatable. The legacy of these philanthropic housing providers is a reminder that slavery is not just a historical issue. It is a legacy that continues to shape the world today. We must continue to fight for racial justice and to ensure that the horrors of slavery are never forgotten.

Comments

Post a Comment